THE PRACTICE OF CARE:

A PROVIDER’S GUIDE

PERSONAL INJURY CLAIM

RESOURCES FOR

HEALTHCARE

PROFESSIONALS

Hidden Benefits

MEDICAL BILLS & WAGE LOSS

Hidden Benefits and Things That May Surprise You

About PIP Policies

Even with over 120 years of combined legal experience in our firm, we continue to learn new things about PIP all the time — whether it’s finding hidden PIP policies, or knowing if the Letter of Protection you received is worth more than the paper it’s printed on. The Medical Bill and Wage Loss section on our website contains updated information.

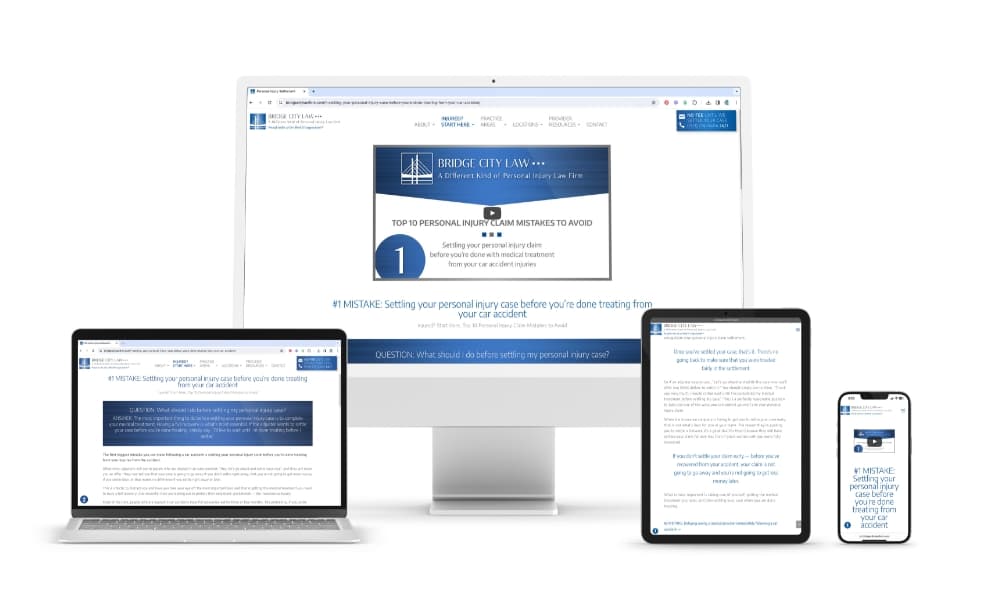

VIDEOS

ARTICLES

#1 What happens when my patient's Personal Injury Protection (PIP) runs out?

If your patient’s PIP benefit becomes depleted, there may be additional PIP policies your patient can access to cover the cost of their ongoing treatment. Knowing the right questions to ask your patient will help to uncover if there are other PIP policies they can utilize.

If your patient is a passenger in a friend’s car and they’re involved in an accident, your patient will make a claim on the PIP policy that covers the car that they were in during the accident. But, if the PIP coverage for that policy is exhausted and on the day that the collision occurred, your patient had car insurance on their own car — they have a secondary PIP policy they can use.

If the second PIP policy is also depleted and your patient still needs more medical treatment — again, if on the day the car accident happened, your patient was living with a family member who had their own insurance policy, your patient may be able to tap into that policy as well.

The Oregon PIP statutes state that PIP coverage is available for any family member residing in the household, at the time of the auto accident. Your patient does not have to be named as an insured on the family member’s policy.

#2 My patient won’t take time off from work, what should I do to support their treatment?

We often find that our clients have never made a PIP claim and may not even know that they have PIP benefits and what that means for them following a car accident. You may have patients who have never made a PIP claim or understand that their PIP coverage includes a wage loss benefit.

If your patient does understand their PIP wage-loss benefit, the maximum payment is $3,000/month or 70% of their wage loss — whichever is less and that is oftentimes not enough for your patient to meet their expenses and get by.

Sometimes the biggest roadblock for your patient taking time off work for their treatment is their employer. There are, unfortunately, a number of employers who will not be supportive of your patients getting the care they need for their recovery. This can be a challenging barrier to work around.

If your patient is fired because they cannot do their work — they’re still entitled to receive their wage loss benefit for the time period they’re taken off work. When they’re released to return to work, the wage loss benefit through their PIP policy stops. But they may not be in a situation where they can take that chance — understandably.

#3 Is there a difference in how Personal Injury Protection (PIP) works if my patient is injured as a pedestrian?

If your patient was hit by a car and injured as a pedestrian, and they had their own auto insurance at the time of the accident, they will actually file a PIP claim with their insurance company.

If they didn’t have their own car insurance at the time of the accident — or if their PIP benefits become exhausted — if your patient was living with a family member when the accident happened who had their own car insurance, your patient can file a claim on their family member’s PIP policy.

If neither of those scenarios are options, Oregon statute requires that your patient use their health insurance to cover their medical expenses from the accident.

Only when your patient is a pedestrian, can they make a claim on the driver who caused the accident’s PIP policy. Filing a claim against the driver’s PIP coverage will require that your patient to provide documentation for your patient’s medical expenses not covered by their PIP policies or health insurance to be considered.

#4 Will Personal Injury Protection (PIP) pay my patients wage loss for missed time from work because of treatment?

The Oregon PIP statute does not require the PIP carrier to pay for missed time from work for your patient’s medical treatment for the injuries from their car accident.

Even though your patient’s lost wages for going to their medical appointments is not covered by their PIP policy — if someone else was at fault for the car accident, when it’s time for your patient to settle their personal injury claim, they are entitled to be reimbursed for their lost wages for the time they missed for their treatment appointments.

The important consideration for your patient to be reimbursed for their lost wages is that they have someone at their place of employment who will document each time they’re away from work and for how long for their medical appointments. This documentation will be required by the at-fault driver’s insurance company and will ensure that your patient is reimbursed.

#5 What should I tell my patients when the Personal Injury Protection (PIP) adjuster keeps calling them for updates?

Your patient has a legal obligation to cooperate with the PIP carrier. That means they have to 1) sign a medical records release authorization — which they should NOT do until they’re done with their treatment, and 2) throughout the time they’re receiving treatment, they’re required to give updates about their recovery status when the PIP adjuster asks.

One of the biggest mistakes your patient can make when giving a treatment update to the PIP adjuster is giving too much information. The critically important thing they need to understand is that less is more when talking to the adjuster. Advising your patient to keep their answers short and succinct will not only protect their PIP benefits, it will also protect their personal injury claim.

You can support your patient in keeping their PIP benefit so they can get the treatment they need by advising them to communicate to the PIP adjuster that they are getting better and to provide a percentage range of their improvement — ‘60% – 65% percent better,’ as an example.

Explaining to your patient so that they understand what the adjuster is looking for will help them respond to their questions in a way that won’t jeopardize their PIP benefits and will reduce the likelihood they’ll be sent to an IME.

#6 Will Personal Injury Protection (PIP) pay for additional treatment after I’ve released my patient from care?

The biggest factor in whether the PIP carrier will pay for your patient’s medical treatment after you’ve released them from your care is how much time has gone by from when you last saw your patient to when they contacted you requesting additional treatment. The more time that’s gone by between when you released them from your care to when they asked to be treated again is going to be more challenging to have your patient’s PIP policy cover their treatment.

What you can do is when you release your patient from your care, let them know that if they do have a flare-up and the pain and discomfort from the injuries from their accident return, to contact you as soon as possible and to not wait to be examined. That keeps you current and up-to-date with your patient’s recovery, helps your patient get the treatment and care they need, and will minimize conflict with the PIP carrier over paying the bills for their medical treatment.

If you have questions or concerns about your patient in this situation, we’re happy to talk with you and provide you with an analysis as to the likelihood that your patient would prevail in having their medical bills covered if the PIP carrier initially refused to pay for the additional care.

#7 Are there limits with my patient’s PIP coverage as to the type and number of Medical Providers my patients can see?

When your patient has been injured in a car accident, there are advantages to them having PIP benefits over the benefits they receive with their health insurance coverage. Many require that your patient see medical providers within their Managed Care Organization. So, for example, if your patient has Kaiser health insurance, they’re only able to see providers within the Kaiser network.

Additionally, within most health insurance plans, your patient is required to make an appointment and be examined by their primary care physician to receive a referral to a specialist — which is not a requirement when your patient uses their PIP benefits.

Your patient is also able to see a variety of healthcare professionals to help them recover from their injuries.

So, for example, if your patient feels they would benefit from seeing a chiropractor, an acupuncturist, and a massage therapist, they are free to do that.

We hear from our clients all the time that they did not realize that the PIP coverage that’s a part of their car insurance policy is essentially an additional health insurance policy — with very few limitations and barriers to navigate that they typically experience with health insurance coverage.

#8 My patient is self-employed, does that affect their wage loss claim?

Whether your patient is an employee, or they’re self-employed, provided their medical provider takes them off work for 14 consecutive days — and they provide proper wage loss verification, they are entitled to 70% of their lost wages, up to a maximum of $3,000 a month.

If your patient is self-employed it gets a little trickier because of the type of lost wage verification that is required. The longer your patient has owned their business and keeps organized and detailed bookkeeping records, the less challenging it is for them to provide the required documentation.

There can be the additional challenge that not all self-employed people report all of their income. If that is the case with your patient, they won’t have the required documentation to prove all of their lost income. It’s also not unusual for the PIP carrier to require your patient to submit their last two years of tax records.

For your self-employed patients, they are entitled to receive a portion of their lost wages through their PIP coverage. It can be very beneficial for them to talk with an experienced personal injury attorney. The lawyer will ask them a variety of questions about their self-employment status and guide them on how to navigate the PIP wage loss process to help them receive the wage loss benefit they’re entitled to.

#9 Are there any problems that can arise for my patient, if I bill their health insurance?

If your patient has exhausted their PIP benefit and you’re considering billing their health insurance, your patient should check to see if their health insurance policy has what’s called a “futures penalty clause.” If there is this type of clause in their policy contract it can create problems for them in the future.

What that clause simply means is, that if the health insurance company pays for any medical care related to a car accident, when the health insurance company is reimbursed for the medical bills that they paid out for your patient, they will not pay for future medical treatment related to your patient’s body parts that were injured in the collision.

The important consideration and question to ask is if it’s more likely that your patient will need future medical care on their neck — if so, you will want to be cautious in billing your patient’s health insurance — especially, if you anticipate they may need injections or surgery.

If your patient was injured in a motor vehicle collision and their PIP is depleted — before you bill their health insurance, we strongly encourage healthcare professionals to consult with an experienced personal injury attorney.

#10 What should I tell my patient if they are being sent for an Independent Medical Exam (IME)?

Insurance companies send people injured in an accident to an IME for one reason and that is to obtain a medical report from doctors who they’ve hired to examine your patient and provide them with a report justifying that they can stop your patient’s PIP benefits for medical treatment.

Most of your patients will not have seen a medical provider who will be examining them for someone else’s benefit. This means they won’t be aware that during their IME, they won’t have the patient-doctor confidentiality that they’re used to having.

It is important for your patient to know that even though there isn’t a patient-provider relationship during their IME it’s critical to their credibility that they clearly and concisely respond to the IME doctor’s questions about any similar past injuries, treatment, and pre-existing conditions. The insurance company will share your patient’s medical records with the IME doctor and any inconsistencies or omissions by your patient will be used by the IME doctor in their report to attack your patient’s credibility.

Your patients need to be prepared to easily and succinctly articulate their answers to the IME doctor’s questions about how their injuries are continuing to impact them as well as their progress. Any uncertainty or lack of clarity in your patient’s responses will harm their credibility.

MORE PERSONAL INJURY ARTICLES & RESOURCES

To Help You Manage the Complexity of the Claims Process

By following our posts,

you will find helpful information to share with your patients, and straightforward suggestions for you and your staff to avoid mistakes that could potentially harm your patient’s claim.

For HEALTHCARE PROFESSIONALS Only

Here we’ll 1) post our weekly 2-3 minute information-rich videos and content-relevant blog posts the day they’re released, 2) respond to your questions, and 3) provide an opportunity for you to engage with other members.

Every six weeks, we’ll round-up the five most recent posts developed especially for medical providers treating patients who have been in an accident and deliver them directly to your inbox.

FOLLOW US

On Your Preferred Social Media Platform

We’ll post reminders to check our blog for new resources to help you better advocate for your patients and important steps to follow to insure you’re paid for the care you provide.

THE PRACTICE OF CARE:

A PROVIDERS GUIDE

Personal Injury Claim Resources for Healthcare Professionals

YES, I would like to receive THE PRACTICE OF CARE periodic emails and resources.

"*" indicates required fields