#8 My patient is self-employed, does that affect their wage loss claim?

QUESTION: My patient is self-employed, does that affect their PIP wage loss claim?

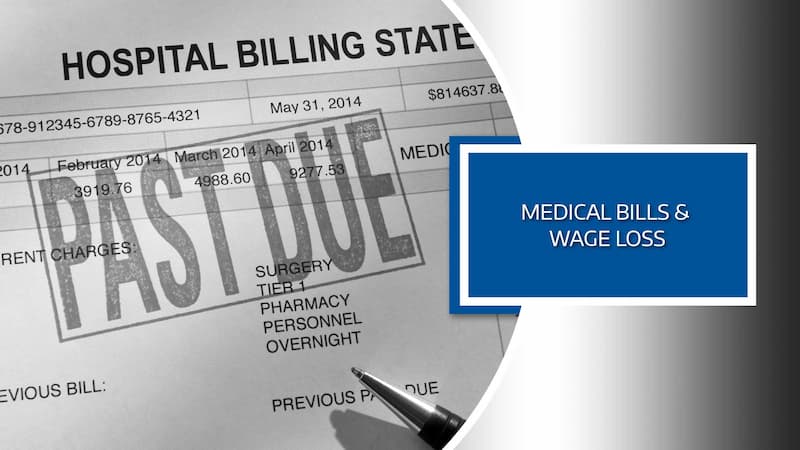

ANSWER: Whether your patient is an employee, or they’re self-employed, provided their medical provider takes them off work for 14 consecutive days — and they provide proper wage loss verification, they are entitled to 70% of their lost wages, up to a maximum of $3,000 a month. If your patient is self-employed it gets a little trickier because of the type of lost wage verification that is required. The longer your patient has owned their business and keeps organized and detailed bookkeeping records, the less challenging for them to provide the required documentation.

My patient is self-employed, does that affect their PIP wage loss claim?

The short answer to that question is no.

Your patient being self-employed does not mean that can’t file a wage loss claim against their PIP policy.

Whether your patient is an employee, or they’re self-employed, provided their medical provider takes them off work for 14 consecutive days — and they provide proper wage loss verification, they are entitled to 70% of their lost wages, up to a maximum of $3,000 a month.

If your patient is self-employed it does get a little trickier because of the type of verification of lost wages documentation that is required. That is the challenging part. It’s much more straightforward to provide verifiable lost wages through most employers. The Human Resources department or a managing supervisor can verify that your patient works for the company, the number of hours a week they work, how much they’re paid an hour or their monthly salary — and the days they have missed from work because of their injuries. That type of wage-loss verification obviously doesn’t exist when your patient is self-employed.

While they are indeed entitled to lost wages — there’s a lot more documentation they must provide.

The longer your patient has owned their business, and keeps organized and detailed bookkeeping and accounting records through software programs, like QuickBooks, it will be less challenging for them to provide the required documentation. The less time they have owned the business and/or if they don’t keep careful track of their bookkeeping and business records, the harder it will be to assemble the documents they need to prove their lost wages.

There can be the additional challenge that not all self-employed people report all of their income. We’ve had many clients who under-report their income by 50%. If that is the case with your patient, they will not have documentation to prove all of their lost income.

It’s also not unusual for the PIP carrier to want your patient to submit the last two years of their tax records.

For your patients who are self-employed, they are absolutely entitled to receive a portion of their lost wages through their PIP coverage. It can be very beneficial for them to talk with an experienced personal injury attorney. They provide a no-fee, no-obligation initial consultation. They will ask your patient a variety of questions about their self-employment status and guide them on how to navigate the PIP wage loss process to help them receive the wage loss benefit they’re entitled to.

We’re here to be a bridge of support for you and your patients.

We have developed a robust library of information for your patients who have been injured in an accident, which can be found in the INJURED? START HERE portal on our website.

There are 40 topic-focused articles, with accompanying videos, organized into the four categories that include the personal injury claim-related questions we’re asked most often, which include:

- Top 10 Personal Injury Claim Mistakes to Avoid

- What You Need to Know About Your Claim

- How Are My Medical Bills & Wage Loss Paid

- How to Prepare for Your Independent Medical Exam

Each article provides advice and guidelines to help your patients navigate each phase of the personal injury claims process. Whether we represent your patient or not, we are passionate about them knowing how to protect their rights, get the medical care they need, and avoid the mistakes that can harm their personal injury claim.

Each article provides advice and guidelines to help your patients navigate each phase of the personal injury claims process. Whether we represent your patient or not, we are passionate about them knowing how to protect their rights, get the medical care they need, and avoid the mistakes that can harm their personal injury claim.

Additionally, if it would be helpful to have the information we feature on our website available in your office to pass along to your patients, we’ve developed brochures for each of the four article series -- in both English and Spanish that we’re happy to send to your office. Please complete the form below and we’ll get them out to you promptly.